When we are experiencing financial difficulties, perhaps the only thing we require immediately is a quick cash advance. We may have a plethora of options when it comes to selecting the proper service for obtaining instant cash. Some of us will opt for a line of credit through traditional lenders such as retail banks or credit unions. However, it could be a viable solution only if you have a good credit rating and if lenders are confident in your creditworthiness. Note that these traditional lenders may not consider you eligible if you have a poor credit history. This is regarded as one of the most serious problems that Americans face. Do not be demotivated; you may still have a reasonable alternative in the form of an installment credit from an online lender.

What is an Installment Loan?

Installment loans are amounts ranging from $1000 to $100,000 that are to be paid back over months or even years. These debts are also called "consumer credit" and are appropriate for large purchases such as a car or a house.

.jpg)

The advantages of such debts include longer terms and affordable interest rates. In addition, payment intervals on this type of financing are precise and fixed. For example, if you borrowed $1,000 at a 20% interest rate, you might be asked to pay $92.63 per month for a year.

About Installment Loans Online

If you are short on cash and have a bad credit score but need cash fast, you can consider monthly installment loans online. This type of lending allows you to get financed without having to go to a brick-and-mortar lender. When your online application is approved, the funds will be available in your bank account.

The most advantageous aspect of online installment loans is that lenders do not conduct a hard credit check prior to approving the case. As a result, people with bad credit can get consumer credit online.

Worth noting that different lenders provide different terms; therefore, you must conduct research and compare prices. The benefits of having installment credits available online are enormous because potential customers can learn about real people's experiences by reading customer reviews.

Four Types of Installment Loans

It's interesting to note that these credit options can come in a variety of types. Examples of installment credits include mortgages, auto, personal, and student loans. Each type has distinct characteristics and is intended for a specific need.

Auto loans are secured funds designed to buy a vehicle. You borrow the vehicle's cost and make monthly payments that include interest over a 12- to 96-month period. Longer-term car loans typically have lower monthly cash installments but higher interest rates.

Mortgages are designed to finance the purchase of a home. This type of secured debt has longer terms ranging from 15 to 30 years. Like auto loans, customers borrow the price of the house and commit to repaying it with interest in monthly installments.

Personal installment loans or so-called "commercial" loans are intended for personal use only. Borrowers must reimburse in regular scheduled payments or installments over a period of one to eight years. They are typically subject to higher interest rates than other types of installments due to the fact that personal advances are unsecured and do not usually require collateral.

Student loans are intended to assist students in financing their post-secondary education. Interest rates for such credit are typically very low. The length of the student advance is determined by the requested period, which is typically the entire academic year, one semester, or a quarter.

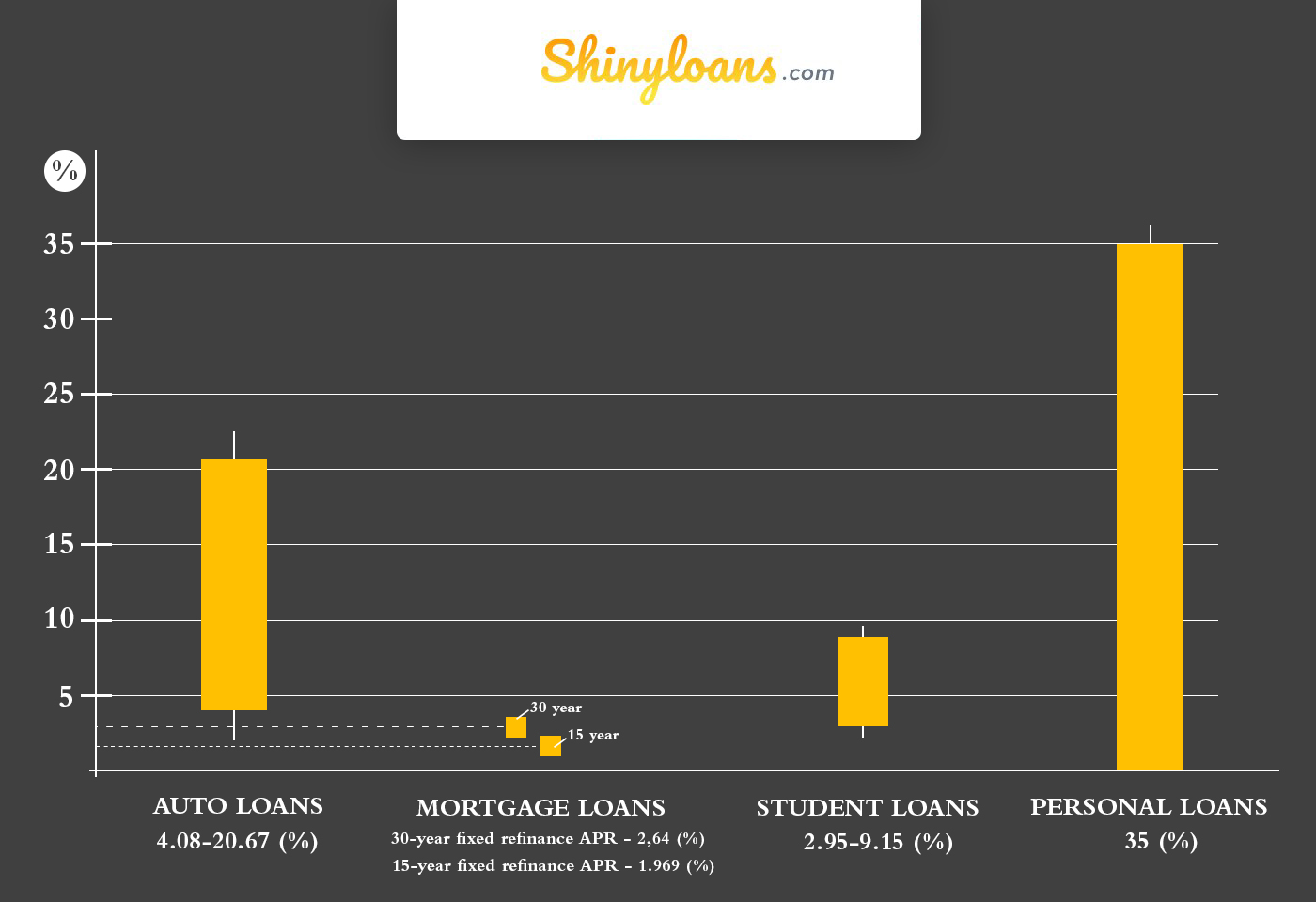

Interest Rates

The Bankrate published a list of the best consumer credits online 2021, with APRs ranging from 4.98 percent to 35.99 percent. Of course, each installment loan has its own interest rate. For example, auto loans range from 4.08 percent to 20.67 percent, while mortgage lenders offer a 30-year fixed refinance APR of 2.624 percent and a 15-year fixed refinance APR of 1.969 percent. The interest rates on student loans range from 2.95 percent to 9.15 percent, while personal advances have a maximum APR of 35 percent.

How do Installment Loans Work?

Nowadays, online platforms make it very easy to obtain credit. Borrowers simply fill out an online application form, provide some personal information, submit the completed form, and wait for feedback from lenders. Online lenders typically make a decision within minutes and notify the client via email. If the customer agrees to work with the lender who approved his case, he should contact the lender, get informed about the whole procedure in detail, sign an agreement, and receive the funds directly into his active bank account.

Personal Information Required for the Request Form

Online request forms are simple to fill out. You must only provide your full name, date of birth, home address, email and phone numbers, Social Security number, driving license, government-issued ID, source of income, and an active checking account. Borrowers must be at least 18 years old and permanent residents of the United States.

The purpose of the financing must also be mentioned on the online application form so that the lender can specify the purpose of the debt and determine the amount.

Pieces of Advice for Borrowers

Before opting for installment lending, there are a few pointers that every customer should keep in mind:

- The accessibility of consumer credit allows you to get easy, quick cash, but this does not mean you should take out more than you need. To make appropriate financial management decisions, you must first understand your financial requirements and find how much you will need to cover them.

- Before deciding on any type of financial assistance, compare your options to ensure you choose the one with the lowest interest rates and terms. Don't go with the first thing you see and end up in a financial bind.

- Consider your repayment strategy carefully, as it can significantly impact your financial stability. Make a plan to pay your bills on time so that you don't fall behind your finances. Try to cut back on your spending and stick to your budget to avoid missing any substantial payments.

- Do your best to make your payments on time. Prices on installment loans are much more affordable because you are not required to pay the borrowed amount in one lump sum. However, it is possible to fall behind on your payments, so take extra precautions to avoid late payments. If you want to build trustworthy credit, you should pay all your debts on time.

- Try to pay off your debt as early as you can. If you repay the debt as soon as possible, the derived interest will be minimal. However, find out if your lender imposes a prepayment penalty first.

Consequently!

We can assume that installment loans are very flexible and can be used for a wide range of purposes, from small personal purchases to big-ticket items. The only thing to remember before taking out any credit is to prioritize your budget so that you can pay off the debt in full and on time. In the event of a default, you may become trapped in a debt cycle that can lead to an endless circle and jeopardize your financial stability. As a result, take only what you can afford and don't complicate your life.

(2).jpg)

%20vs%20IRA.jpg)