About DTI

What is the debt to income ratio? Should all Americans be well-versed in this phenomenon, or would a basic understanding suffice? The debt to income ratio (level of indebtedness or DTI) is the percentage of the gross monthly income that goes toward paying monthly debt obligations. A low DTI level makes a borrower more appealing. It is one of the most important factors that lenders consider when making a loan. They use the ratio of debt to measure the client’s borrowing risk and often require ratios of no more than 36%.

How to Calculate DTI?

The debt to income ratio calculation is the monthly payment of a loan divided into the monthly income. For instance, you have two loans with $170 and $250 monthly payments, and your gross monthly income is $1000. In this case, the debt to income ratio formula will have the following scheme: 420 (170+250) /1000×100=42%. These kinds of calculations are the main base for the lenders to understand the borrower’s ability to serve the obligations.

The estimate is based on the borrower's monthly income, not their yearly income. In informal financial literature, the DTI is viewed as the borrower's capacity to obtain a loan. In other words, if your financial load exceeds your gross income, lenders may reject your application since you would be unable to meet your commitments adequately. There is some truth to this since the borrower must have a significant income not just for the monthly payments of the credits but also for a living salary. The essence of the level of indebtedness may even be identical to the customer's credit score.

More About Debt-To-Income Ratio

The ratio of debts takes into account the payment of recurrent commitments. The recurrent phenomenon implies that debts cannot be canceled or transferred at any moment. Mortgage loans, vehicle loans, and student loans are examples of such liabilities. You will not be able to get rid of this type of debt unless you pay it off. On the other hand, other commitments, such as internet agreements and phone bills, allow you to pay a little later or even cease using their service. Be aware that this type of responsibility is not included in the DTI level because, in most cases, it is part of the living wage. The topic of revenue includes not only salary and earnings but also money from child support or your online store.

The Appropriate DTI Ratio

Essentially, the permissible DTI will fluctuate depending on the type of loan you plan to qualify for. For mortgage loans, for example, the typically accepted range is a maximum of 50 percent; however, this also depends on the financial institution. According to the Consumer Financial Protection Bureau, borrowers with a higher level of indebtedness are considerably more likely to experience a financial crisis due to their inability to make monthly payments. Most landlords prefer no more than 33 percent; however, some may be OK with 45 or 50 percent.

Calculate Your DTI Now!

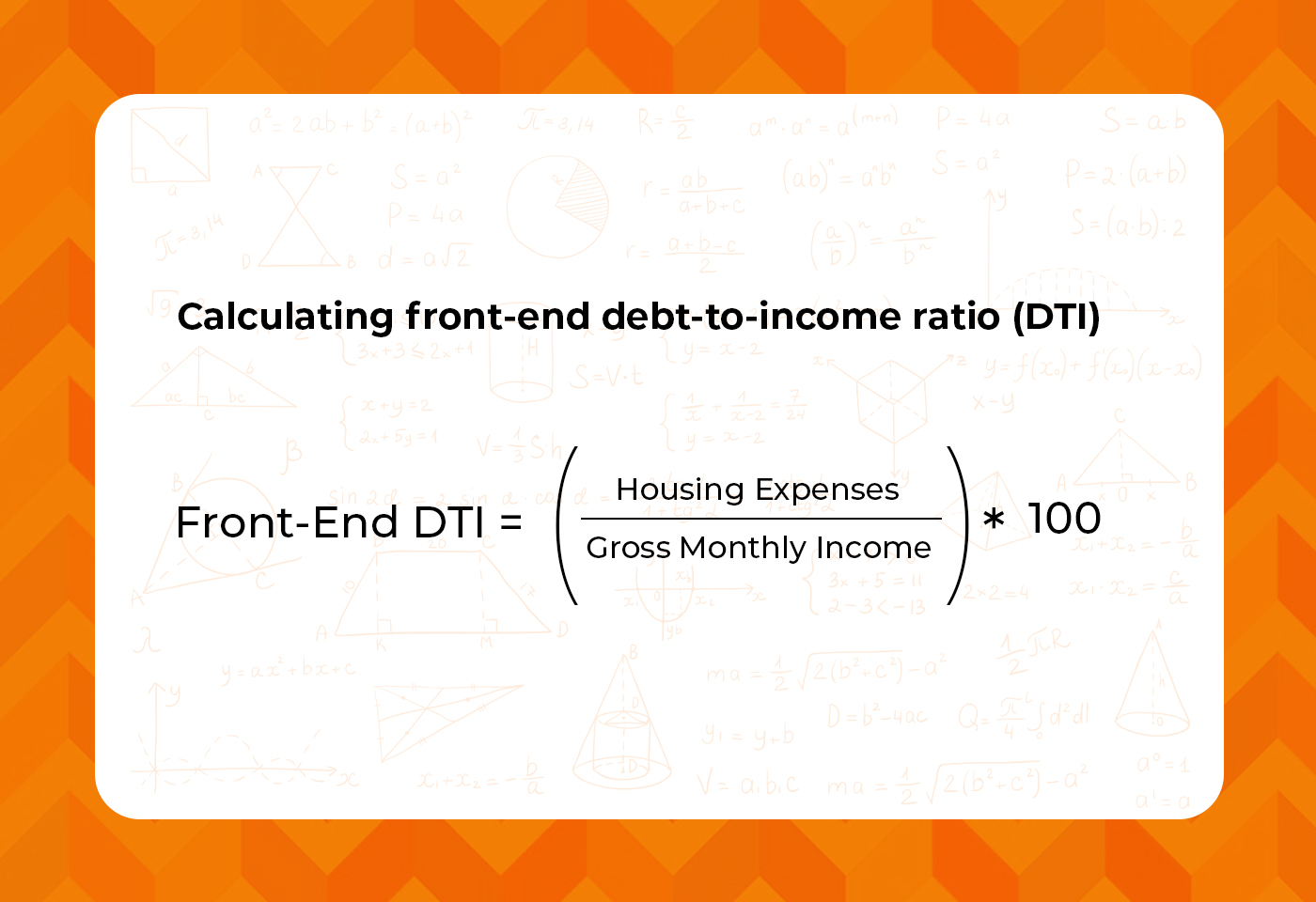

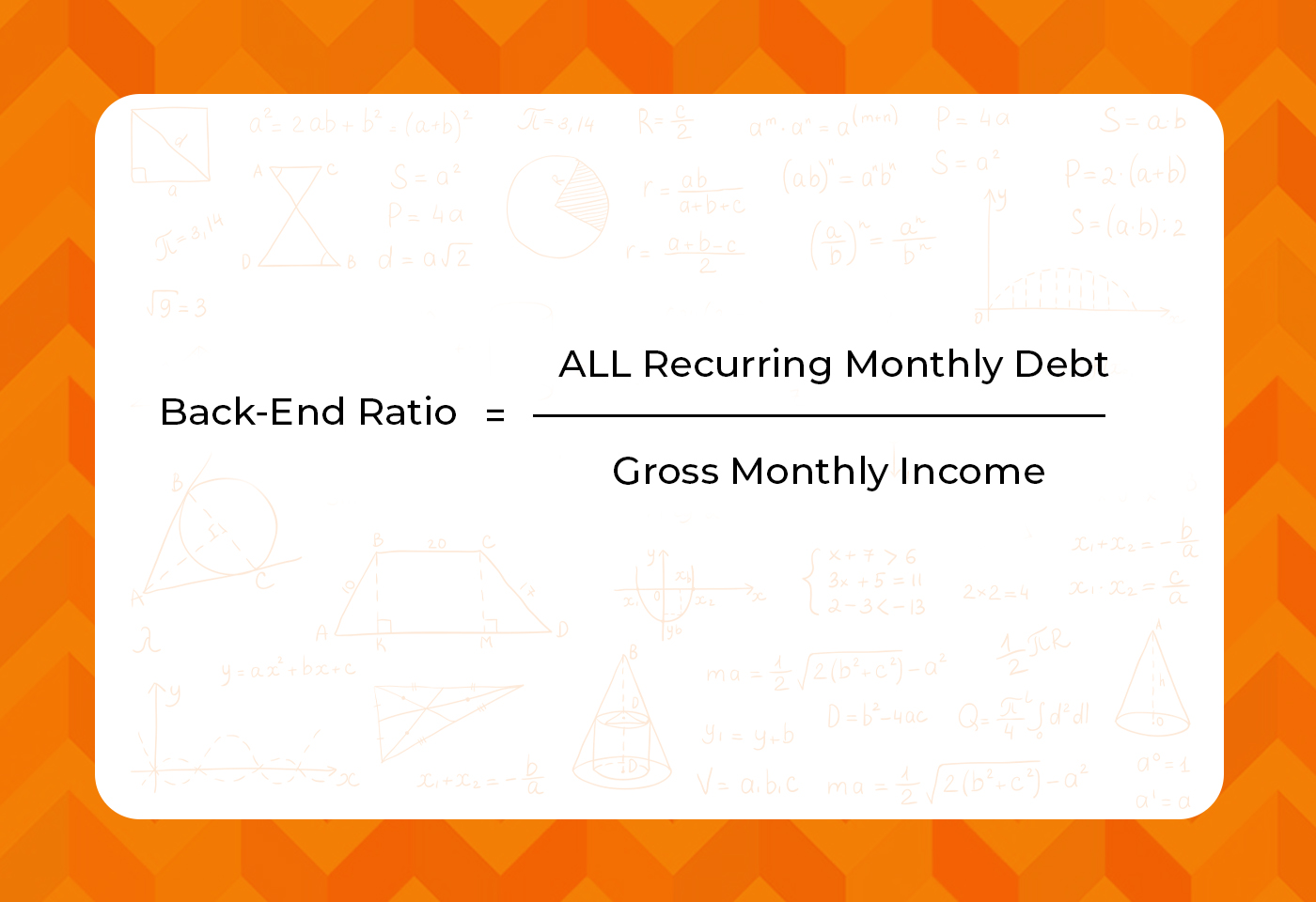

If you're still confused about how to calculate debt-to-income ratio, you should keep reading. To figure out what to use in your monthly debt payment, you need to know whether lenders are looking at your front-end or back-end DTI. The housing ratio, also known as the front-end DTI, analyzes how much of a person's gross income is spent on housing expenditures. A back-end DTI determines the percentage of gross income spent on other forms of debt, such as credit cards or vehicle loans. The images below show two different interpretations of what the debt-to-income ratio formula looks like.

Begin by compiling all of your monthly debt payments, including school loans, vehicle loans, credit card bills, alimony, child support, and others. Then add either the front-end or the back-end DTI. Once you get the total, divide it by your gross monthly earnings, including taxes and other deductions, to determine your proportion of debts.

Furthermore, you may simply determine the proportion of your level of indebtedness by using an online debt-to-income ratio calculator. Simply input your current income and payments to get your expected DTI level. The online calculator can assist you in comprehending what your DTI implies for you.

Is DTI a Component in Credit?

According to major credit agencies Experian, TransUnion, and Equifax, credit scoring systems such as the FICO® Score and VantageScore® construct credit scores based on your credit utilization and repayment history. Because credit bureaus do not monitor your income, credit scoring algorithms cannot compute debt ratios or apply them to your ratings.

However, though income is not included in credit reports, borrowers with a high DTI proportion may have a high credit utilization ratio, which counts for 30% of their credit score.

How to Lower DTI

Maintaining a reasonable level of debt is one of the keys to good financial health. If your level of indebtedness is near to or more than 36 percent, you should consider taking actions to lower it. The first steps you should take are as follows:

- Start paying more toward your debt each month. Extra payments might help you pay off your debt faster.

- Avoid incurring additional debt delaying the application for more loans.

- Extend the life of your loans. This might be a strategy to reduce your monthly debt payments.

- Postpone significant purchases to use less credit. Using less credit can help keep your debt ratio low.

- Keep your level of indebtedness under control, recalculating it monthly.

- Find a way to supplement your income. This can help you increase your income while also meeting your debt commitments.

- To minimize your DTI and credit utilization ratio, first pay off the loan with the highest interest rate.

A lower DTI might be advantageous in a variety of ways if you're considering taking on more loans. For example, your debt-to-income ratio might influence the terms under which lenders finance you. It may also function as a financial health indicator.

Are You Eligible to Take Out a Loan with Your Current DTI?

Still unsure if your funds and financial reputation are in good enough shape to take on a loan? Your DTI and credit score assess various parts of your financial health, and improving both can help you succeed. However, if you have a low level of indebtedness and are unable to qualify for loans, Shinyloans offers a potential choice for you.

If you want immediate cash to cover unforeseen bills, same-day online loans may be your only option. To apply for an online payday loan, simply go to our website and complete the online application form. There is no need to arrange an appointment or wait in lengthy and tedious lines because the entire process is totally automated. Your cash will be promptly deposited into your account when our lenders receive your application and approve it.

Please bear in mind that our platform does not lend money; it is a platform that connects lenders and borrowers. The amount of money offered ranges from $100 to $2500 and is determined by the state in which you live. Also note, that payday loan providers do not compute the DTI ratio since their standards are less stringent, as explained on our website: Shinyloans.com.

.jpg)

.jpg)

.jpg)

.jpg)