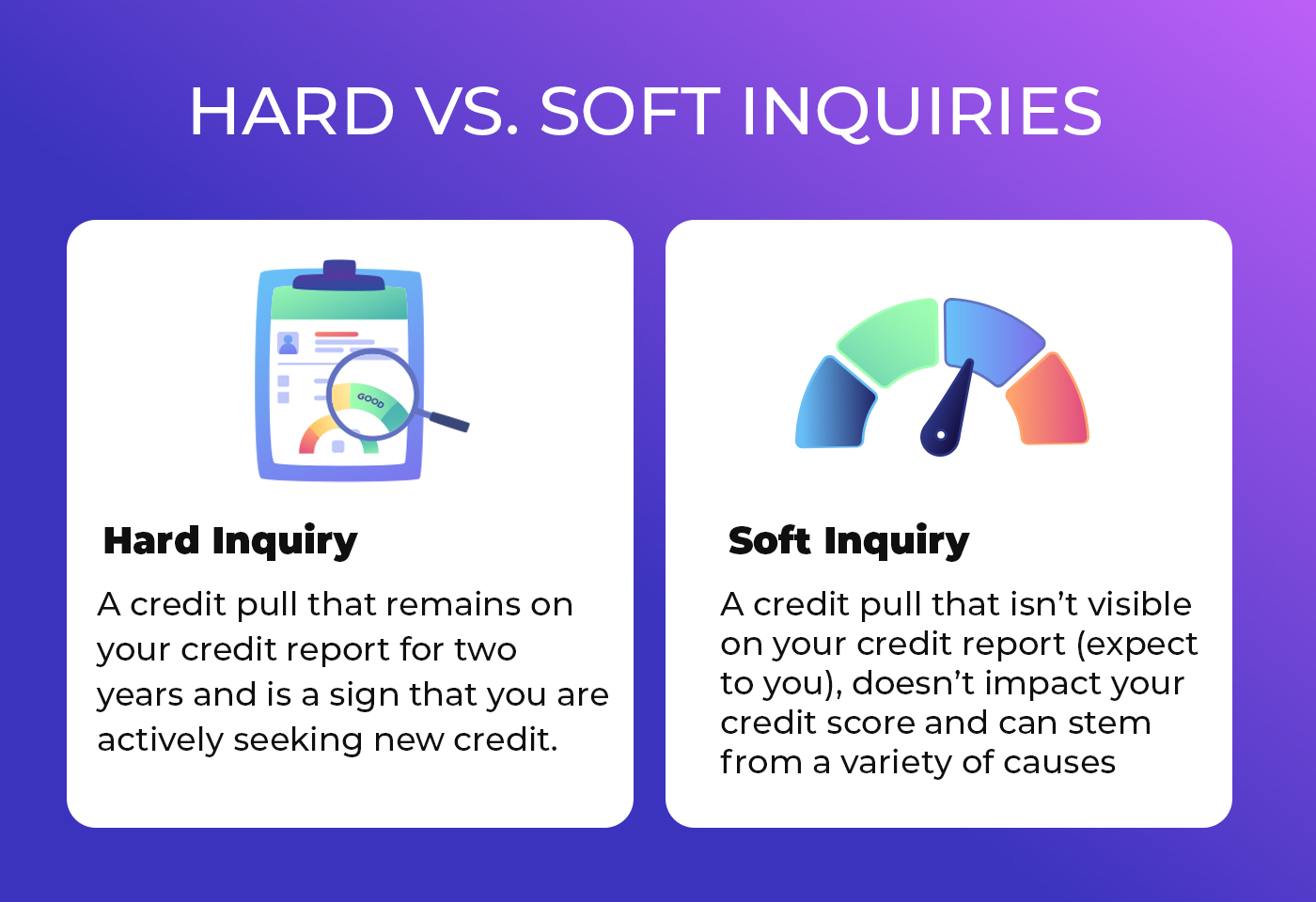

What Are Credit Inquiries?

Credit inquiries are a form of a request for financial report data from one of the major reporting organizations. There are two types of inquiries: hard and soft. Soft inquiries happen when borrowers examine their records on their own or when the credit card company requests inquiries for pre-approval. Soft checks have no effect on the borrower's FICO score and, more importantly, do not show up in the client’s financial history. Hard inquiries, on the other hand, are utilized for decision-making, and this type of report may have an influence on the borrower's FICO score.

Do not be Afraid to Check Your Credit Reports

Some people hesitate to examine their financial reports not to negatively impact their ratings. However, pulling your personal credit report will result in an inquiry, but will have no effect on your FICO score. In fact, understanding what information is in your yearly report and checking it may help you develop the habit of keeping track of your financial records.

More About Hard Inquiries

A hard inquiry, also known as a hard pull or hard credit check, necessitates the client's permission. When you apply for a mortgage or a car loan, the lender will almost certainly ask you to obtain permission to check your report with one or more of the major reporting agencies (Equifax, Experian, and TransUnion). This type of inquiry is classified as a hard inquiry since it is closely related to the application that the client must fill out.

The number of hard inquiries has a significant impact on your FICO score and the lending process. According to financial specialists, too many hard inquiries in a short period of time should inform lenders that the applicant is having financial difficulties with bill payments or problems with expenditures. A large number of hard inquiries, on the other hand, may indicate that the applicant is attempting to secure the best attainable rate in the market, but in any event, keep in mind that having several hard inquiries on your financial report will undoubtedly harm your score. Aside from inquiries, the FICO score includes the following elements: payment history, credit mix, duration of credit usage, and credit utilization ratio. Nonetheless, some banking professionals argue that inquiries are not the most important factor in calculating ratings.

How Hard Credit Pools Affect Your Credit

If you completely meet the standards of FICO score components, with the exception of numerous inquiries, you may be certain that your application will not be refused with a 99 percent chance. You might be wondering, "Why do inquires play a minor part in scoring if they are also a component of the scoring system?" In informal literature, such an issue is connected to the primary and secondary components, and if your financial records meet all standards (excluding inquiries), the presence of several inquiries may be considered secondary.

On the other hand, this does not imply that you should be less cautious when conducting hard pulls; instead, you should keep your eyes on it. If you discover inaccurate information on your financial report that was committed without your consent, you should contact the reporting agency and request that the inquiry be removed. An "unlicensed" hard inquiry may reveal fraud or identity theft.

More About Soft Inquiries

In general, soft inquiries (also known as soft credit pulls and soft credit checks) are associated with situations in which the applicant examines his or her own report or provides permission for another individual to study the financial report. Soft inquiries are used by credit card issuers or insurance firms to pre-approve an offer. Because the importance of soft inquiries is not as great as that of hard inquiries, they are only visible to candidates. However, there are a few exceptions:

(1) Insurance firms have the right to view the soft inquiries conducted by other insurance companies.

(2) Debt settlement companies' inquiries may be shared with your active creditors.

Soft pulls are not factored into the scoring system, thus they have no effect on your credit score. They are solely provided as a reference, and no potential lenders have access to them.

Payday Online Loans and Soft Credit Inquiries

If you have a bad financial history and an insufficient FICO score, you may be ineligible for traditional lending options since you do not meet the scoring system's standards. Do not despair; you may be able to apply for payday loans with speedy approval through our connecting platform, Shinyloans.com.

Payday online loans provided by trustworthy lenders are not reflected in the hard inquiries. In other words, if you have an online same-day loan, it will not affect your yearly history.

How Long do Inquiries Stay on Your Credit Report

The question "how long do hard inquiries stay on your credit report?" may come up from time to time. Remember, hard inquiries act as a record of when you sought new credit. Thus, they may "reside" on your financial report for roughly two years, but the impact they may have can last for a long time. Soft inquiries on a credit report, on the other hand, have no effect on your FICO ratings and do not stay on your financial records.

How to Remove Inquiries From Credit Report

Because soft pulls have no negative impact on financial histories, people do not even consider removing them from their records. Hard pulls, on the other hand, have an impact on our financial history, therefore we develop strategies to delete them from our financial records. Remember, hard queries cannot be erased unless they are the consequence of identity theft. Alternatively, they'll have to fall off on their own after two years. However, working with the major reporting agencies and, in certain cases, the creditor who initiated the query is required when disputing hard inquiries on credit report. It may sound enticing to remove inquiries from credit report in order to raise your score. However, disputing a real hard inquiry on your credit report is unlikely to result in a difference in your FICO ratings.

For Your Information!

Keep in mind that there are different forms of credit checks that might seem as a hard or soft inquiry. Utility, cable, internet, and telephone companies, for example, will frequently check your credit. If you're unclear if a particular query will be classed as hard or soft, contact the firm, credit card issuer, or financial institution involved to differentiate between the two.

Before Looking for a Loan

It's usually a good idea to manage your money ahead of time before looking for a loan. It is critical to be aware of the possible consequences of inquiries and to carefully monitor when and how frequently new inquiries are generated. First, determine if the sort of credit you're seeking will result in a hard or soft inquiry. Second, you should examine your report to understand what information is published in it. Every 12 months, you are provided with a free copy of your financial reports from each of the three national reporting agencies. The more you know about what occurs when you apply for a loan, the better you can prepare for it. Before you begin loan shopping, learn more about credit queries to better prepare for the effect they may have on your yearly history.

.png)

.jpg)

.jpg)