If you are in a financial crisis due to unplanned bills that necessitate quick financial solutions, you may be able to benefit from online loans. However, traditional lenders, such as banks or credit unions, may not be able to provide you with the money you require in the shortest time limits, as payday lenders used to. Thus, keep in mind that even if you choose to avail of a traditional lender's service, you may still be rejected due to a poor credit score or history. However, your past financial mistakes may not hinder online lenders who are ready to give a helping hand to almost every US resident in need. But there is one crucial thing to consider while taking out online payday loans: a bit higher interest rates and loan fees. Ahead are the most typical costs associated with loans, whether traditional or online.

Traditional lendings usually come with the following loan fees together with interests.

Monthly Service Fees

Monthly service fees mainly refer to traditional lenders. The maintenance of saving/checking accounts of the customers usually imposes monthly maintenance fees. Some banks apply monthly maintenance fees when the cardholder makes "no exceed" of the minimum number of transactions. Be aware that payday lenders do not charge maintenance fees; however, the borrowers may have stricter charges in other areas.

Poor Balance Fees

Poor balance costs also refer to traditional lending institutions. The insufficient balance is the fact that each of us may face at any time. For instance, you would like to withdraw $100, but you have only $50 on your account, which means you might exceed your balance by $50. Due to the development of technology, most banks provide an opportunity to have access to your accounts. It is a highly comfortable thing, as you can check your balance and forecast your financial management. The other way to protect yourself from the low balance cost is to activate the low balance alert. Clients can fix the low balance limit and get acknowledgments when the balance drops below the specified level based on the low balance service. This service is generally similar to the overdraft protection charge. Be informed that there is no such notion with online payday lenders.

Overdraft Fees

The overdraft protection service secures clients from withdrawing funds from insufficient balance accounts. This service is helpful when you are close to exceeding your account limit, as low balance charges will be imposed. Even if you withdraw an amount you do not have on your detailed account, the service may automatically redirect the source of funds and provide the account with a positive balance. Payday borrowers are free from such charges.

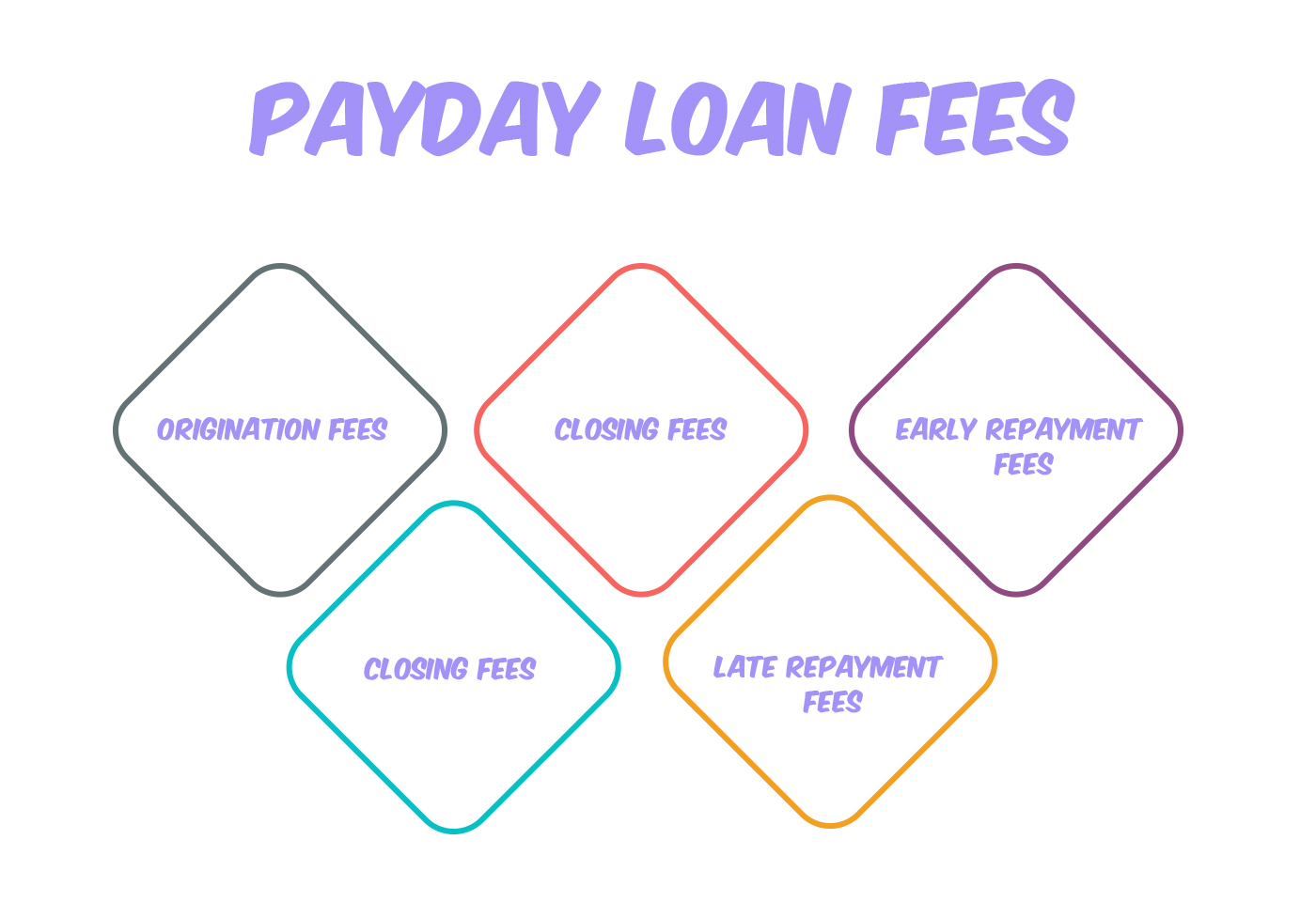

Both traditional and online lendings may have these fees:

ATM Charges

Nowadays, many financial institutions try to get rid of the usage of cash. However, in any case, the role of ATMs in our daily life has not come to be smaller. ATMs may have hidden fees if you use the teller machines not associated with the bank that operates your checking/saving accounts. In this sort of case, the charges may be doubled and imposed not only by the ATM operating bank but also by the account holder's bank. The hidden fees may even exceed 20 percent of the cashed amount. To escape the withdrawal costs, try to find banks with fair ATM coverage and use the ATMs not associated with your bank only if the need for cash is unavoidable.

Online loans are directly deposited into the borrowers' bank account, so the latter is obliged to use ATMs more frequently. Therefore, we advise opening an account with a bank that charges less for cash withdrawal for these borrowers.

Origination Fees

Origination fees are intended to cover the expenses of the processing and approval of your borrowing, which includes validating your data. Both traditional and alternative lending types come with origination costs (charge from the loan's total amount). Payday and personal loan origination charge calculators help the borrowers to figure out the actual costs of these charges. It is worth mentioning that there are lenders that offer “personal loan no origination fees.”

Loan Possessing Fee

While processing, the lenders imply some administrative charges. This is normally a minor sum that varies per bank and lender ranging from 0.5 percent to 2 percent of the overall borrowed amount.

Closing Fees

Closing costs embrace all of the charges associated with the processing of your loan, from origination to processing fees. However, rather than revealing them separately, banks will sometimes group them and refer to them as "closing expenses." It is because banks will not charge the costs until the debt is closed, typically bundling them in with the entire amount and including them in your monthly payments.

Prepayment Penalties

The bank's profit is estimated based on the amount of interest you will pay throughout the life of the loan. If you pay off the loan early, they will charge you less interest. Because this reduces their profit, banks will frequently include a condition in the agreement that permits them to charge you a prepayment penalty. If you pay off your loan early, you must pay this cost. However, you may not face prepayment penalties when it comes to online lending. These charges are critical factors to consider, thus before signing any loan agreement, make sure there are no such penalties.

Late Payment Penalties

If not paying the monthly payments on time, the borrowers will be charged penalties. These fees are usually fixed; nevertheless, they may increase if your late payments become frequent.

The loan fees mentioned above should be worded in the agreement. The borrowers are strongly recommended to read the close of the contract up to the end to find out everything is clear to them. If there is any discrepancy in the agreement, they may cancel it.

Final Thoughts

When looking for a borrowing option, the first thing that comes to mind is checking the interest rates and processing costs, affecting everything from your initial charges to your monthly payments. Thus, before dealing with any lending, borrowers should arm themselves with full knowledge of the lender’s loan service fees. Remember that knowing the loans' actual costs helps the borrowers stay on top of their finances.

.jpg)

.jpg)

(1).jpg)

.jpg)

.jpg)

.jpg)

.jpg)