Debt is a thorny issue. What began as a tiny sum might suddenly balloon due to interest charges. This does not include any extra loans or credit acquired, which can cause debt totals to skyrocket. This is why debt collection is challenging not just for you but also for your lender. Thus, many prefer settling the debt for less than you originally owe rather than going through the lengthy collecting procedure. When you're struggling to manage your finances, it might seem like progress is slow or non-existent. This may increase the attraction of a debt forgiveness program.

Today we will talk about various debt forgiveness programs and learn how to qualify if you are financially strapped. But first, let's go through what is debt forgiveness and how it works.

How Does Debt Forgiveness Work?

In a nutshell, the loan forgiveness definition is described as a straightforward process where your lender cancels a part or all of the amount you still owe. However, this enticing premise nearly always comes with a catch. Keep an eye out to avoid the dangers of wishful thinking before truly contemplating forgiveness of debts as a possibility. Knowing the traps of a forgiveness scheme and spotting possible scams might save you a lot of trouble in the future.

Different Types of Debt Forgiveness

Aside from filing bankruptcy, there are just a few options to have your financial obligations canceled. Although not all forms of financing tools are eligible for these programs, here are some options and information on how to get debt forgiveness.

Student Loan Forgiveness

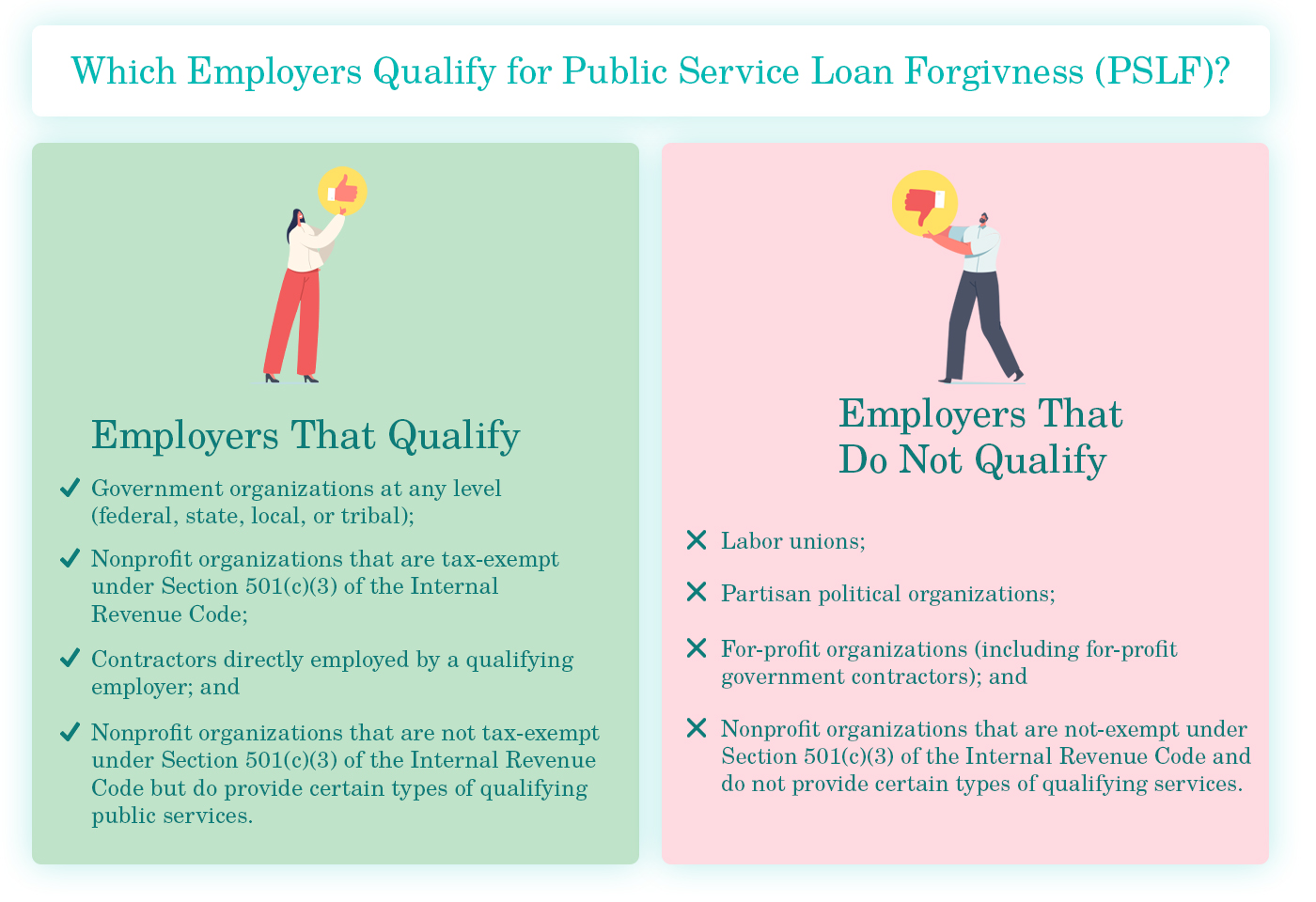

This type of financing is the final authentic approach to persuade a creditor to cancel the outstanding payment you still owe. They mainly cover federal student loans and are designed so that it is tough to qualify. They also require making payments for a set length of time until the amount due is forgiven. The best choice for student credit debt forgiveness is the Public Service Loan Forgiveness program administered by the U.S. Department of Education. It operates by canceling loans to qualifying borrowers who work in particular industries for a set period. Eligibility criteria for this program are quite strict, such as staying in a certain position for a lengthy period of time. If you can make it through the initial 10-year payback period, your outstanding federal student loan may be canceled at the end.

The next program is income-driven repayment, where your student loan is being canceled after 25 years of payment. Although this program forgives you the remaining balance at the end, you will be required to pay extra taxes for the canceled money owing. It's vital to remember that these forgiveness programs only apply to federal student loans, but not for private lenders' relief. Consult your lender or review the U.S. Department of Education's handbook to get more information on student loan forgiveness possibilities.

Mortgage Debt Forgiveness

Similar to student loans, the government often provides a wider variety of credit debt forgiveness for federal mortgage loans than for private ones. For instance, those with Federal Housing Administration loans may qualify for a range of forgiveness programs to customize your original credit to your current financial state or help avoid foreclosures. On the other hand, Home Affordable Modification Program (HAMP) may help lower both monthly installments and a large amount of your overall loan sum if you qualify.

For other homeowners, the U.S. The Department of Housing and Urban Development proposes mortgage loan relief and monthly installment reduction. Another option accessible via HUD is the Principal Reduction Alternative program, which can assist homeowners by decreasing the total money owed on a mortgage when it is much greater than the home's value.

Visit the HUD Making Home Affordable website to learn more about various HUD services you may opt for. You can also contact your lender to inquire about what assistance is available.

Public Service Loan Forgiveness (PSLF)

If you labor (full-time) for a federal, municipal, state, or tribal government in the United States or a non-profit entity, you may be eligible for student loan forgiveness. To qualify for the debt forgiveness program, you must make at least 120 consecutive payments. This will not work for recent grads because it takes at least 10 years to complete. You must be involved in a Federal Direct Loan Program or consolidate your federal loans into a direct loan.

Credit Card Debt Settlement

Seeking cash relief may be a solution to eliminating the amount due if you are significantly behind on your credit card bills, however not without consequences. Debt settlement is a procedure in which a third-party agency negotiates an arrangement to pay back less than you owe. Many credit settlement firms want you to cease making monthly payments during negotiations with your lender. This may result in missed payments and consequently late payment fees. Aside from hurting your credit, settlement may also be a costly decision since you have to pay for bet settlement services. Credit settlement should be a last resort for those who have exhausted all other options for getting out of financial hardship. Although credit settlement may help eliminate amounts due, it doesn't work as a forgiveness program and should be considered as such. If you're thinking about using a debt settlement organization, do your research first.

Alternative Debt Relief Options

Debt forgiveness and settlement are not the only options to explore while managing your financial burden. If you decide to employ either of these techniques, it is vital to keep making on-time payments and have a good credit history. The payment history is the key factor going into your score calculation, so even a single missed or late payment may negatively impact your credit score.

Negotiation: If you're facing financial difficulties, it's always a good idea to engage directly with your lender. Don't wait until you fail to pay back the loan or at least fall behind on your payments. Instead, contact out and be honest; many lenders offer programs intended to assist customers in getting through difficult times.

Debt Consolidation: The next common debt-reduction strategy is consolidating all the money owing into a single monthly bill, preferably with low interest. Credit consolidation may assist in saving money on interest in paying smaller amounts each month. However, consolidation cannot ensure that you will not be indebted again. If you have the habit of living over your budget, you may do it again after being debt-free.

Debt Management Plan (DMP): If you encounter hardship managing debt, talk to a credit counselor about building your personal DMP. A credit counselor may not only help you create a DMP but also strictly stick to it. Depending on your financial state, DMP may include combining payments, reducing interest rates, or simply establishing proper budgeting. As long as you complete all of your payments on schedule, this strategy may be a viable option for dealing with outstanding payments.

If you're thinking about any of these alternatives, it could be a good idea to acquire your credit report to see what your credit looks like. For example, at annualcreditreport.com, you may get a free credit report from each major credit reporting agency to review your current financial state.

Things to Know Before Considering Debt Forgiveness?

If a prospective solution to financial difficulties sounds too good to be true, it almost certainly is. Some businesses offer to assist you in avoiding or reducing your monthly payments – for a price, of course. Check the Better Business Bureau rating of a firm before signing paperwork or giving money to any third-party company. Any firm you engage with must provide you with precise, time-bound results, as well as detail how all of your charges will mount up for your payback period (all in writing).

Take some time to consider the pros and cons and answer some key questions, such as "will I pay taxes on forgiven or discharged amounts," "will the extra interest be manageable," or "how long will it take to achieve a payback date." Then, make certain to do the math and choose the most cost-effective choice.

The Bottom Line

If you believe you cannot pay off all of your bills, avoid the urge to hide your head in the sand. Ignoring your problems will not make them disappear, but making a plan will offer you faith and a chance to fight. Begin by contacting your creditor to explore debt forgiveness or credit repayment options available to you. A credit counselor can also assist you in considering your alternatives, including bankruptcy. It's not a quick cure, but if you analyze the advantages and expenses, you could just develop a debt management strategy that works best for you.

.jpg)

(2).jpg)

.jpg)

.jpg)

.jpg)